PRODUCTS

OPENAI

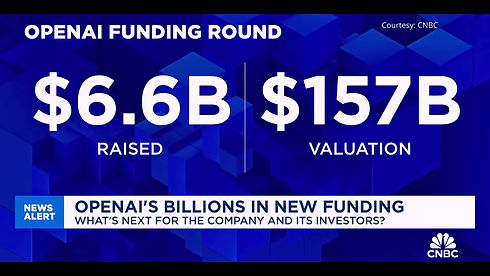

In April 2025, OpenAI secured a landmark $40 billion funding round led by SoftBank, valuing the company at $300 billion and positioning it among the world’s most valuable technology firms. The financing—initially $10 billion with a further $30 billion contingent on OpenAI’s transition to a for-profit structure by year-end—will accelerate AI research, expand global compute infrastructure, and scale products such as ChatGPT, now used by over 500 million people weekly. Concurrently, OpenAI launched Stargate LLC with SoftBank, Oracle, and MGX, targeting up to $500 billion in U.S. AI infrastructure investment by 2029.In April 2025, OpenAI secured a landmark $40 billion funding round led by SoftBank, valuing the company at $300 billion and positioning it among the world’s most valuable technology firms. The financing—initially $10 billion with a further $30 billion contingent on OpenAI’s transition to a for-profit structure by year-end—will accelerate AI research, expand global compute infrastructure, and scale products such as ChatGPT, now used by over 500 million people weekly. Concurrently, OpenAI launched Stargate LLC with SoftBank, Oracle, and MGX, targeting up to $500 billion in U.S. AI infrastructure investment by 2029.

DATABRICKS

In 2025, Databricks closed a Series J round totaling $15.25 billion—$10 billion in equity and $5.25 billion in debt—valuing the company at $62 billion, with backing from Meta, QIA, Temasek, and leading global financial institutions. The capital will fuel AI product innovation, strategic acquisitions, global expansion, and employee liquidity, alongside key initiatives including a partnership with Palantir, a long-term commitment to host its Data and AI Summit in San Francisco through 2030, and a $100 million, five-year collaboration with Anthropic to embed Claude-powered AI agents directly into the Databricks platform.

SPACEX

In 2025, Starlink is projected to generate $11.8 billion in revenue, driven by strong consumer adoption, expanded defense contracts—including a $537 million Pentagon agreement supporting Ukraine through 2027—and rapid international expansion, notably in India via a partnership with Jio Platforms. The company is also transforming inflight connectivity, with United Airlines rolling out Starlink across its entire fleet, while positioning itself for a $2.4 billion U.S. air traffic control communications upgrade, reinforcing Starlink’s growing role in global and national infrastructure.

KLARNA

In 2025, Klarna advanced toward a major milestone with its IPO on the New York Stock Exchange under the symbol “KLAR,” targeting up to $1.27 billion in proceeds at a valuation of approximately $14 billion to support U.S. expansion and global growth. Alongside the listing, Klarna strengthened its funding and partnerships through a multi-year forward flow agreement with Nelnet covering up to $26 billion in U.S. Pay in 4 loans, a €1.4 billion structured financing facility with Santander, and strategic collaborations with Walmart and Stripe—reinforcing its position in global payments and consumer finance.

KRAKEN

In March 2025, Kraken announced plans to acquire U.S.-based futures trading platform NinjaTrader for $1.5 billion, expanding its offering beyond digital assets into regulated futures and derivatives while broadening its investor base. The deal follows a more crypto-supportive U.S. regulatory climate and the SEC’s decision to drop its lawsuit against Kraken, with the transaction expected to close in the first half of 2025 and enable expanded crypto-linked derivatives access in the U.S. and internationally.

SNOWFLAKE

In February 2025, Snowflake reported fiscal 2025 results that exceeded expectations, with revenue up 27% year over year to $986.8 million, product revenue of $943.3 million, and adjusted EPS of $0.30, alongside a 126% net revenue retention rate and more than 11,000 customers. Looking ahead, the company projects 24% product revenue growth in fiscal 2026 to $4.28 billion and is deepening its collaboration with Microsoft by integrating OpenAI models into its Cortex AI platform, reinforcing its position in AI-driven cloud data services.

STRIPE

In 2025, Stripe strengthened its position as a global financial infrastructure leader through targeted investments in AI and stablecoins, highlighted by its $1.1 billion acquisition of Bridge to enhance cross-border payments and programmable money capabilities. The company expanded services across key international markets, deepened its AI-driven commerce offerings—now used by a majority of Forbes AI 50 companies—and announced a February tender offer valuing Stripe at $91.5 billion, providing employee liquidity while underscoring investor confidence. With a renewed focus on profitability, Stripe is reinvesting heavily in R&D to scale its revenue automation platform and next-generation financial technologies.

ABOUT WEB3

Current Web3 developments show growing global momentum as the ecosystem shifts toward utility and real-world adoption in 2026, with major industry events and summits (such as Web3 Hub Davos and regional tech festivals) bringing together leaders, builders, and investors to shape decentralized innovation; strategic partnerships—like High Roller and Power Protocol for enhanced user-engagement models—and new token ecosystems (such as XCN for decentralized finance infrastructure) are emerging, while regions such as Asia, particularly India, are rapidly expanding their Web3 developer bases, regulatory discourse continues (including calls for crypto tax reform), and sectors like Web3 gaming are pivoting toward sustainable, product-driven growth.